Hey y’all! Today, we’re gonna talk about the new Form W-4 for 2020. It’s a pretty important document when it comes to taxes, so it’s worth understanding what it’s all about. Get ready to dive into the world of tax forms!

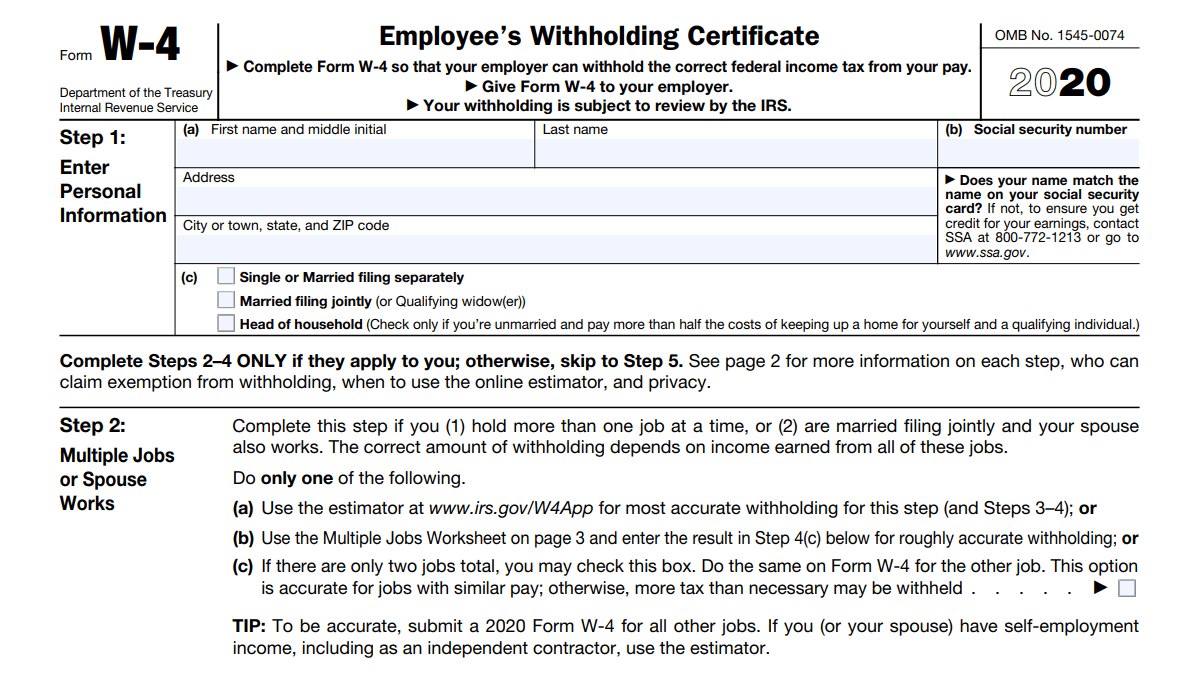

Here’s an image of the new Form W-4 for 2020:

Now, I know tax forms aren’t the most exciting topic, but trust me, understanding them can save you a lot of hassle and even money! So, let’s break it down.

Now, I know tax forms aren’t the most exciting topic, but trust me, understanding them can save you a lot of hassle and even money! So, let’s break it down.

The Form W-4 is a form that you fill out when you start a new job or when you want to make changes to your withholding. Withholding is the amount of money that your employer deducts from your paycheck to cover your income taxes. The purpose of the Form W-4 is to help your employer determine how much to withhold based on your filing status, number of dependents, and other factors.

It’s important to note that the new Form W-4 for 2020 is different from previous versions. The IRS made some updates to make it more accurate and easier to use. The changes were made in response to the Tax Cuts and Jobs Act, which went into effect in 2018.

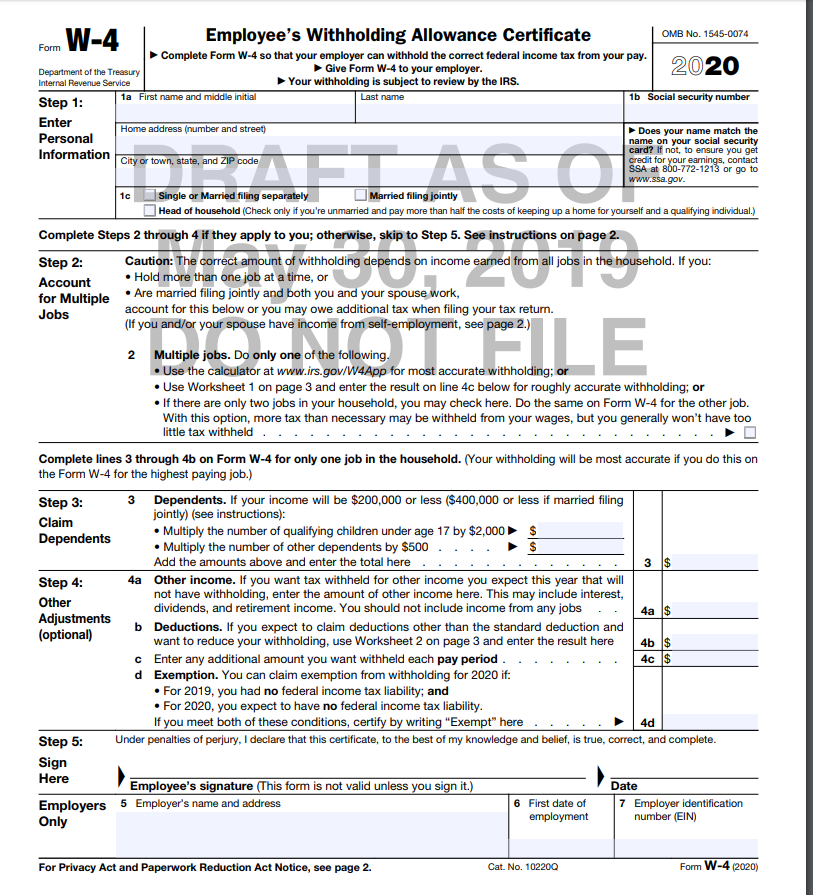

Here’s another image of the new Form W-4 for 2020:

One of the key changes is the removal of allowances. In the past, you would indicate the number of allowances you wanted to claim on your Form W-4. The more allowances you claimed, the less money would be withheld from your paycheck. However, starting in 2020, allowances are no longer used. Instead, there are now specific fields where you enter additional income, deductions, and tax credits, if applicable.

One of the key changes is the removal of allowances. In the past, you would indicate the number of allowances you wanted to claim on your Form W-4. The more allowances you claimed, the less money would be withheld from your paycheck. However, starting in 2020, allowances are no longer used. Instead, there are now specific fields where you enter additional income, deductions, and tax credits, if applicable.

The new Form W-4 also includes a section for multiple jobs or a working spouse. This is helpful if you have more than one job or if you’re married and both you and your spouse work. By providing additional information about your other income sources or your spouse’s income, you can ensure that the correct amount of taxes is withheld.

Here’s another image of the new Form W-4 for 2020:

Now, you might be wondering why all these changes were made. The main goal was to increase accuracy and simplify the form. The previous system of allowances had its flaws and often resulted in either over- or under-withholding. The new system aims to prevent this and ensure that you’re withholding the correct amount of taxes throughout the year.

Now, you might be wondering why all these changes were made. The main goal was to increase accuracy and simplify the form. The previous system of allowances had its flaws and often resulted in either over- or under-withholding. The new system aims to prevent this and ensure that you’re withholding the correct amount of taxes throughout the year.

It’s important to fill out the Form W-4 accurately to avoid any surprises come tax season. If too much is being withheld from your paycheck, you may be giving the government an interest-free loan. On the other hand, if too little is being withheld, you might end up owing taxes when you file your return.

So, take the time to review the new Form W-4 for 2020 and make any necessary adjustments. You can find the form on the IRS website or ask your employer for a copy. And remember, if your personal or financial situation changes during the year, make sure to update your Form W-4 accordingly.

Here’s another image of the new Form W-4 for 2020:

That’s all for now, folks! I hope this little guide to the new Form W-4 for 2020 has been helpful. Remember, taxes can be complicated, but taking the time to understand the forms and make the necessary adjustments can save you a lot of stress in the long run. Stay informed, and keep on hustlin'!

That’s all for now, folks! I hope this little guide to the new Form W-4 for 2020 has been helpful. Remember, taxes can be complicated, but taking the time to understand the forms and make the necessary adjustments can save you a lot of stress in the long run. Stay informed, and keep on hustlin'!

Here’s another image of the new Form W-4 for 2020:

And don’t forget to consult a tax professional if you have any questions or need assistance. They can provide personalized advice based on your specific situation. Take care, y’all!

And don’t forget to consult a tax professional if you have any questions or need assistance. They can provide personalized advice based on your specific situation. Take care, y’all!