Are you familiar with the new IRS tax form, 1099-NEC? If not, you’re not alone. The 1099-NEC form is a recent addition to the tax filing process, and it has created quite a buzz among independent contractors and freelancers. In this post, we will explore the purpose of the 1099-NEC form, its key differences from the 1099-MISC form, and why it matters to you.

Printable Blank 1099 NEC Form - Printable World Holiday

Printable Blank 1099 NEC Form - Printable World Holiday

The first resource we have is a printable blank 1099 NEC form from Printable World Holiday. This form can be filled out online and then printed for submission to the IRS. It provides a convenient way to ensure that you are accurately reporting your nonemployee compensation.

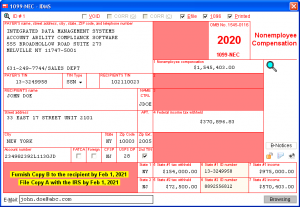

1099-NEC or 1099-MISC? What has changed and why it matters! - IssueWire

1099-NEC or 1099-MISC? What has changed and why it matters! - IssueWire

Next, we have an informative article from IssueWire that breaks down the key differences between the 1099-NEC and 1099-MISC forms. It explains that the 1099-NEC form was reintroduced in 2020 to specifically report nonemployee compensation, which had previously been reported on the 1099-MISC form. This change was made to improve tax reporting accuracy and streamline the filing process.

New 1099-NEC Form For Independent Contractors | The Dancing Accountant

New 1099-NEC Form For Independent Contractors | The Dancing Accountant

The Dancing Accountant provides an in-depth look at the new 1099-NEC form and how it impacts independent contractors. The article explains that the 1099-NEC form is now used to report nonemployee compensation, such as fees, commissions, and other forms of payment for services. This change ensures that independent contractors are accurately reporting their income and allows the IRS to streamline the tax filing process.

IRS 1099-NEC 2020-2022 - Fill and Sign Printable Template Online | US Legal Forms

IRS 1099-NEC 2020-2022 - Fill and Sign Printable Template Online | US Legal Forms

For those who are ready to fill out their 1099-NEC form, US Legal Forms offers a convenient printable template. This resource allows you to easily fill out the necessary information online and then sign the form electronically. It simplifies the process and ensures that you have a professional and accurate document to submit to the IRS.

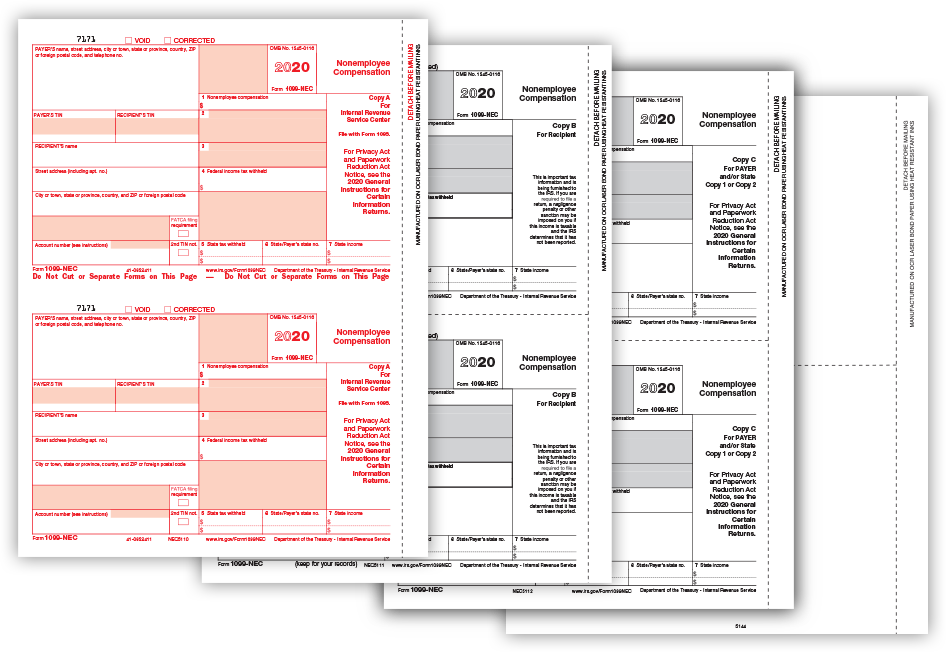

New 1099 NEC Form - 1099 Tax Form changes for 2020 with filings in 2021

New 1099 NEC Form - 1099 Tax Form changes for 2020 with filings in 2021

Tangible Values provides valuable information on the changes to the 1099 tax form for 2020 and how it affects filings in 2021. The article explains that the reintroduction of the 1099-NEC form separates nonemployee compensation from other types of income reported on the 1099-MISC form. This change makes it easier for the IRS to identify and process nonemployee compensation, ensuring accurate tax reporting for both businesses and independent contractors.

1099 NEC vs 1099 MISC 2021 - 2022 - 1099 Forms - TaxUni

1099 NEC vs 1099 MISC 2021 - 2022 - 1099 Forms - TaxUni

TaxUni explains the differences between the 1099-NEC and 1099-MISC forms for 2021-2022. The article highlights that the 1099-NEC form is specifically used to report nonemployee compensation, while the 1099-MISC form encompasses a broader range of income categories. This differentiation allows for more accurate tax reporting and a streamlined filing process.

Form 1099-NEC for Nonemployee Compensation | H&R Block

Form 1099-NEC for Nonemployee Compensation | H&R Block

Leading tax preparation company H&R Block provides insightful information on the 1099-NEC form and its importance for reporting nonemployee compensation. The article emphasizes that accurate reporting is essential for avoiding penalties and ensuring compliance with tax laws. H&R Block encourages independent contractors to carefully review and report their nonemployee compensation using the 1099-NEC form.

Instructions for Forms 1099-MISC and 1099-NEC (2021) | Internal Revenue Service

Instructions for Forms 1099-MISC and 1099-NEC (2021) | Internal Revenue Service

The Internal Revenue Service (IRS) provides comprehensive instructions for filling out both the 1099-MISC and 1099-NEC forms. This resource is valuable for understanding the specific requirements and reporting procedures for each form. It ensures that you have all the necessary information and can accurately report your income to the IRS.

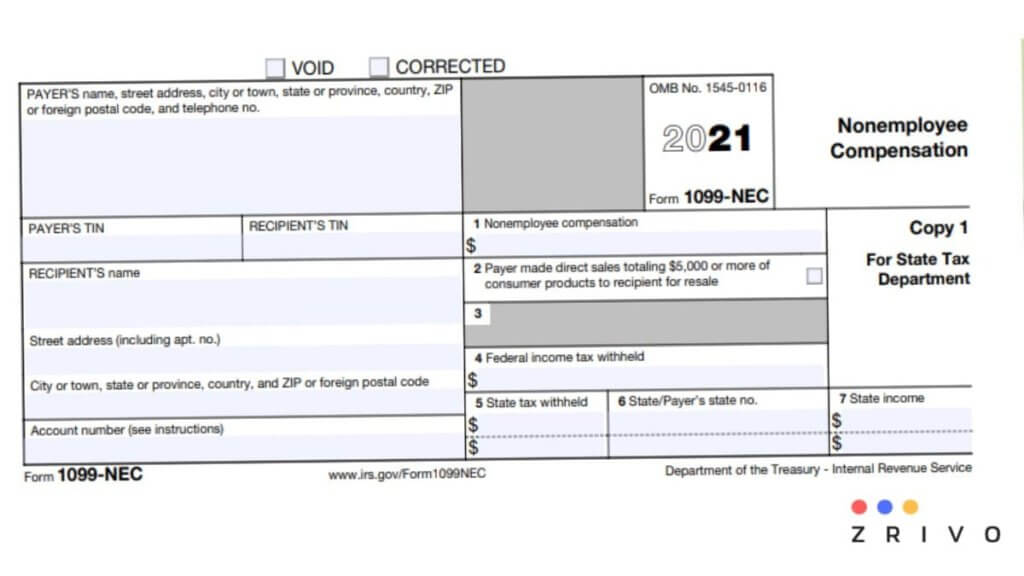

1099 Nec Form 2021 Printable - Get Your Hands on Amazing Free Printables!

1099 Nec Form 2021 Printable - Get Your Hands on Amazing Free Printables!

Zrivo offers a printable 1099-NEC form for 2021. This free resource allows you to easily download and print the form, ensuring that you have a professional document for your tax filing. The article emphasizes the importance of accurate reporting and encourages independent contractors to utilize this printable form to streamline their tax filing process.

Is 1099 Form Printables - Printable Forms Free Online

Is 1099 Form Printables - Printable Forms Free Online

The last resource we have is a blog post from SAP that provides free online printable forms, including the 1099-NEC form. This resource is convenient for independent contractors who prefer an online option for filling out and printing their forms. It ensures that you have access to professional and accurate 1099-NEC forms without any cost.

In conclusion, the introduction of the 1099-NEC form has brought significant changes to the tax filing process for independent contractors and freelancers. It is crucial to understand the purpose and requirements of this form to ensure accurate reporting of nonemployee compensation. The resources provided in this post offer valuable information and tools to help simplify the process and ensure compliance with IRS regulations.